Arts & Culture | COVID-19 | Isaac Bloodworth | Taxes | Daniel Pizarro

Isaac Bloodworth at the opening of his installation Black Kid Joy in front of City Hall last year. Lucy Gellman File Photo.

Isaac Bloodworth has filed his taxes before—but this year feels more stressful. Since 2019, he’s stepped into freelancing as much as possible while juggling a full-time job at the Yale Center for British Art (YCBA). Last year, he cobbled together commissions and did a piece of public artwork for the city. With more gigs came more confusion around taxes.

“The language is confusing because it is supposed to be inclusive but it makes me feel like I'm doing tax fraud,” he said in a recent phone call.

Bloodworth isn’t alone in worrying about taxes this year. Millions of freelancers—many of them artists—have found themselves again mired in the minutiae of tax season, with questions that include unemployment, healthcare changes, missing 1099 forms, and a year upended by halted, postponed, and cancelled performances. While the IRS recently announced that it was extending tax filing day to May 17, several freelance artists, part-time employees, and self-employed artists are still scrambling.

Part of that comes from the fact that millions of Americans collected unemployment for the first time last year. Harold Hack, the Officer Manager at Jackson Hewitt on Whalley Avenue, said that many of his clients have been blindsided by taxes on unemployment benefits. Many were unaware that the IRS considers unemployment benefits as taxable income.

As part of the newly signed $1.9 trillion stimulus package, eligible taxpayers are not required to pay taxes up to $10,200 in unemployment benefits received last year. To be eligible, a person has to have made less than $150,000 in adjusted gross income. For people who have already filed taxes and paid taxes on unemployment benefits, the IRS recommends waiting until new guidelines are issued.

“I wish we had better systems that were more fair,” Bloodworth said. “Rich people get more taxes than low-income folks, Black and Brown folks. Technically, the government knows what you owe them so I don’t understand why we have to go to tax people.”

Last week, a group of New Haveners testified in support of a progressive tax proposal that would increase taxes on people who make more than $500,000 a year and companies that make more than $100 million a year. The bill would aim to transfer money from the wealthiest parts of the state to working-class communities through tax credits, direct payments, and increased funding for state and local social services. The bill was co-introduced by New Haven State Sen. Gary Winfield and Hamden State Sen. Jorge Cabrera.

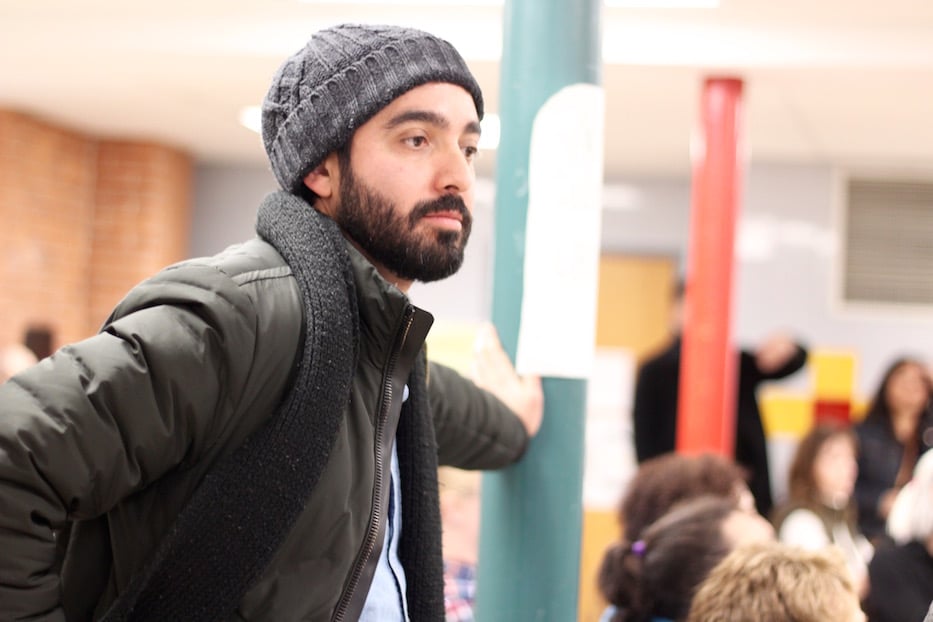

Daniel Pizarro at a December 2019 meeting of Mayor Justin Elicker's transition team. Lucy Gellman File Photo.

Daniel Pizarro at a December 2019 meeting of Mayor Justin Elicker's transition team. Lucy Gellman File Photo.

The fear of getting audited doesn't always go away with more experience. After 10 years of freelancing on the side, Daniel Pizarro founded Daniel Pizarro Studio in 2018 and became self-employed. With the transition came a lack of oversight from the state and federal government, making him responsible for his own taxes.

“I had to develop my business practices from the ground up, like good bookkeeping and tracking systems,” he said in a phone call.

This year, Pizarro is waiting to file taxes because the Paycheck Protection Program (PPP) loan he received is still in legal limbo. The loan covered between eight to 12 weeks of income at a time when he'd lost 80 percent of his clients. He applied for forgiveness but the bank has yet to process the paperwork.

“The bank is like, 'No not yet,'” he said. “That shows me something about how the IRS is going to deal with taxes this year.”

In the more commonly known W-2 form, taxes like state, federal, Medicaid and social security amount to the roughly 30 percent of taxes taken out by the employer on a regular basis. Freelance income rarely has any taxes removed. Hack recommended that freelancers put aside 30 to 35 percent of their earnings to pay those taxes at the end of the year. A freelancer has to pay taxes on a quarterly basis if they are expected to owe $1,000 or more in taxes, but that is mostly applicable to people who are self-employed.

The question of when and how to pay those taxes can be a bit complicated, he added. The amount is calculated through a 1040-ES form. But the form gives only an estimate, since the final numbers aren't confirmed until filing day. If the amount is projected to be less than that threshold, then the filer does not have to pay quarterly taxes.

The first year Pizarro filed as the sole proprietor of the business in 2019, he thought he had done pretty well looking at his earnings. But when he started calculating expenses for the year, he realized he hadn't done as well as he thought. His biggest regret was not keeping better records, he said.

He learned some important business practices, such as standardizing his hourly wage, figuring out which materials and supplies were worth investing in, and keeping spreadsheets for everything.

One of the scariest parts of being self-employed was losing his healthcare, he added. He and his wife Bruni had healthcare through his previous employer. They ended up not having coverage through 2019.

“The whole system was so hard and confusing. It was a scary time,” he said. “What if we got into a car accident? That is all going to come out of pocket.”

Pizarro is in good company. Freelance artist Joy Meikle was unemployed for virtually all of 2020, and then snagged two freelancing gigs at the end of the year. After a year of struggling to find work, she then learned she has to file taxes because her freelance income was more than $400.

She also learned she might have to pay back some money on her HUSKY health insurance because her final income did not match her projected income from when she first applied for the insurance.

“How are we supposed to know when to notify them?” she said. “It just doesn’t make sense.”

Forms, Deductibles and Receipts

A common problem that freelancers run into is 1099 forms, said Hack. Contractors are supposed to issue a 1099 form to a freelancer if the cumulative payment for the year was $600 or more, but companies sometimes don’t. Bloodworth, for instance, hadn’t heard about 1099 forms until an interview for this story. He is now retroactively contacting contractors to get those forms. In order to get the form from the contractor, the freelancer has to provide a W-9 form with basic information to them.

In the event the company does not file a 1099 form in time, the filer still has to report the income. In that situation, it is important to have payment records, such as checks or digital receipts, in the case of an audit.

“If you bring the checks and they add up to $1,463 than I can do that,” said Hack.

Hack also said that most people also get tripped up with deductibles. Deductibles are expenses that are directly subtracted from a person’s taxable income, lowering their overall taxes in most cases.

There are two ways to approach deductibles—a standard deduction and an itemized deduction. In the first, the government calculates a flat deduction of $12,400 for a single person filing or $18,650 for a head of household. In the second, filers itemize how much they paid in state and local taxes, real estate and property taxes, and mortgage interest, as well as charitable donations and medical expenses.

The upside of a standard deduction, Hack said, is its ease—filers can claim it regardless of whether they are a waged employee or self-employed. It also helps people who might not have deductions up to $12,400 in getting a bigger deduction. He added that an itemized deduction can potentially earn a filer a larger deductible than with a standard deduction.

The line between a personal and business expenses can be hard to spot at times, Hack said. If a person has to purchase a work uniform out of pocket to work at a restaurant, then the expense is deductible. However, if that person shows up to work in their regular streetwear and throws on an apron, then the expense is personal and not deductible. To qualify as a home office deduction, the space has to be regularly used for exclusive business purposes and it must be the main space for business. A desk and a computer in the corner of the living room do not qualify, but a separate room for one's office is okay.

Pizarro, for instance, deducts a percentage of his rent based on the square footage of the studio inside his apartment. A list of common deductions is available here and here.

Hack added that he likes when people can bring in a box of physical receipts, because it can help verify deductions. The lack of receipts shouldn’t be a reason to not report the expenses, he added—but listing too many deductibles is a dangerous guessing game. “If it smells, I’ll ask for more information,” he said.

The cost of filing taxes with a tax preparer is not tied to the income, he often reminds people. Fees are added based on the complexity of the taxes and the number of forms that have to be filed.

In addition, the IRS Free File program allows people to file taxes for free if their Adjusted Gross Income (AGI) is below $72,000. Each of the providers has their own criteria for free filing, so it is important to consider all the options and choose the best available one. The tools can also help a person determine if you qualify for the Earned Income Tax Credit (EITC), a refundable tax credit for low- and moderate-income workers.

In New Haven, The VITA (Volunteer Income Tax Assistance) program offers free tax preparation service to low-income individuals and families. VITA has in-person sessions at 280 Humphrey St until April 18. For more information about VITA and other online programs click here.